Dark EA Trading Strategy Overview

The Dark EA is an advanced automated trading solution designed specifically for the MetaTrader 4 platform. Known for its ‘set-and-forget’ approach, it utilizes a unique non-linear formula for market entries, avoiding risky methods like Martingale. This article delves into the features and performance of the Dark EA, providing insights into its trading strategy.

Key Features of Dark EA

- Non-Linear Entry Logic: Employs a specialized formula to determine entry points without relying on standard indicators.

- Safety First: Ensures no volume increases (Martingale) are used to recover losses.

- Risk Management: Incorporates mandatory Stop Loss (SL) and Take Profit (TP) for every trade.

- Spread Protection: Features a spread filter to halt trading during high volatility or broker manipulation.

- Optimized Pairs: Best results on EURUSD, GBPUSD, GBPJPY, EURGBP, EURJPY.

- Timeframe: Optimized for M5 (5-minute chart).

- Plug-and-Play: No need for optimization or .set files; easy to set up.

Requirements for Optimal Performance

- Minimum Account Balance: 1000$ on a cent account.

- Best Performance on: GBPUSD, GBPJPY, EURUSD, EURGBP, EURJPY (Works on any pair).

- Recommended Timeframe: M5 (works on any timeframe).

- VPS: Mandatory for optimal performance; requires a connection with < 10ms latency.

- Account Type: ECN or Raw Spread account recommended; avoid high spread Standard accounts.

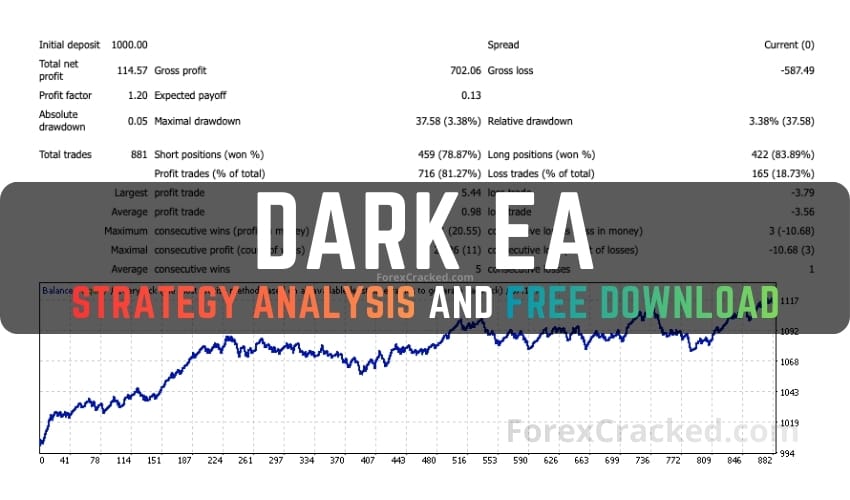

Technical Analysis of Dark EA

We conducted a thorough analysis to verify the claims of the Dark EA Trading Strategy:

- Verification of ‘No Martingale’ Claim: The EA maintains consistent lot sizes across trades, confirming the absence of Martingale strategies.

- ‘Unique’ Exit Algorithm: Utilizes an aggressive Dynamic Trailing Stop to secure profits swiftly.

- Entry Logic: Likely employs a Mean Reversion or Volatility Breakout approach, entering trades on volatility spikes and using tight stops to manage risks.

Pros & Cons

Pros:

- Low Drawdown Risk: Avoids Martingale and uses tight Stop Losses for account protection.

- Profit Locking: Aggressive trailing stops ensure profits are quickly secured.

- Broker Protection: Spread filter prevents trading during liquidity gaps.

Cons:

- Execution Risk: High reliance on fast order modifications; suitable for low-latency environments.

For optimal results, download and test the Dark EA on a demo account to understand its mechanics before live trading.